Stock PickingDiscovering potential winners

We believe high-quality businesses can make an excellent foundation for most long-term portfolios. The trick is finding them. That’s where our team of experienced portfolio managers comes in. Using our proprietary Four Pillars of Quality, they find companies they believe can thrive over the long term, potentially rewarding shareholders along the way. This first layer sets the foundation for all we do.

Learn more about how we pick stocks

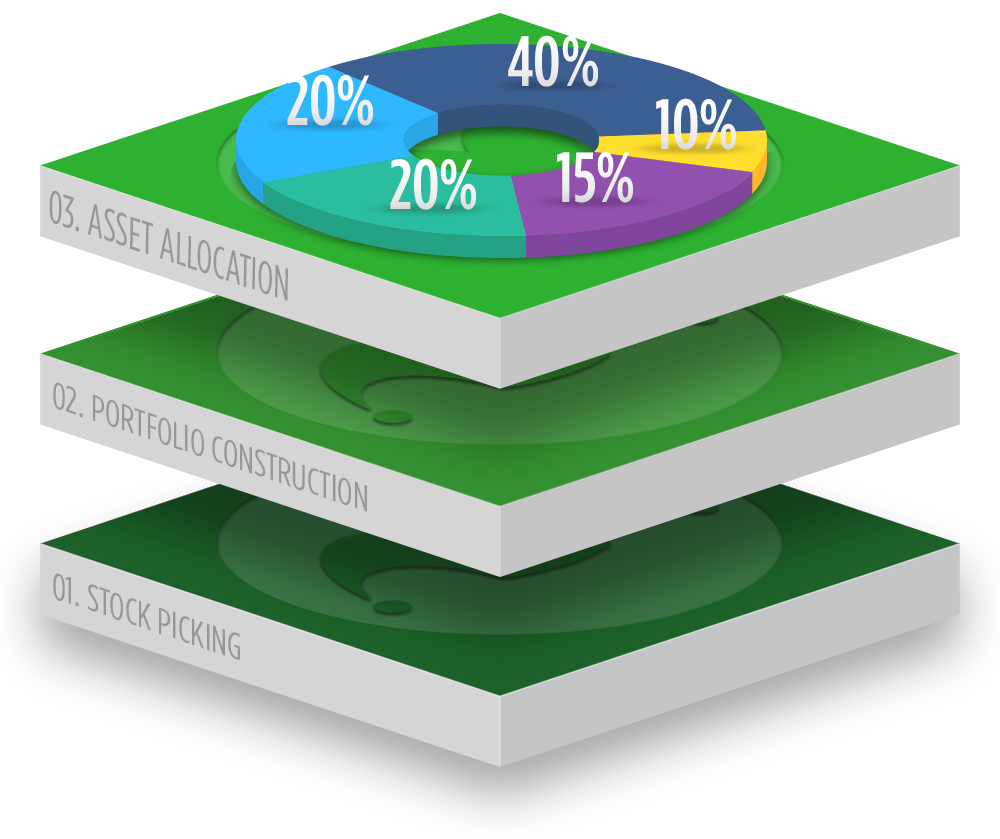

Portfolio ConstructionManaging risk/reward

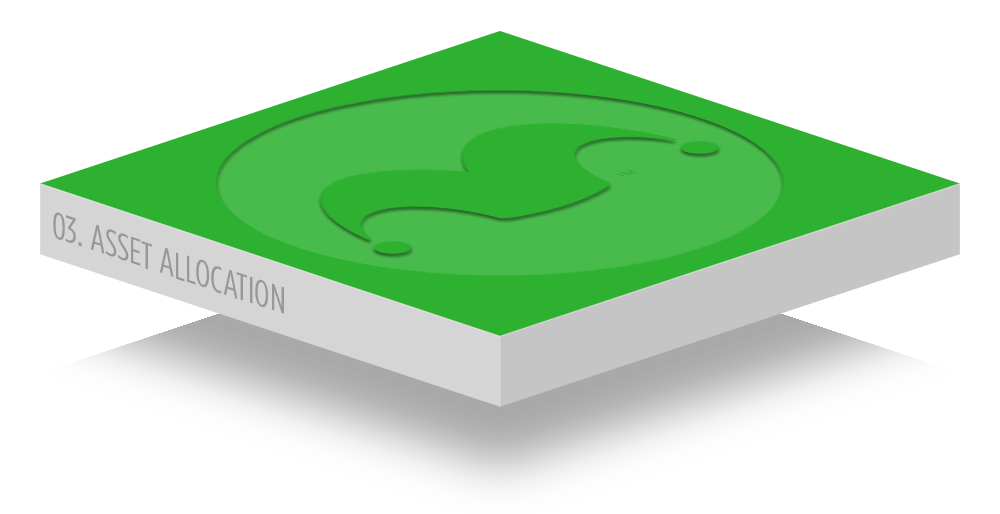

It’s one thing to find great stocks. Heck, you may have picked a few winners yourself over the years! But getting select baskets of stocks working together in concentrated portfolios is a whole ‘nother challenge. We run six distinctive portfolio strategies geared toward specific kinds of stocks (see the list to the left) along with one Fixed Income strategy. These strategies only include our portfolio managers’ highest conviction picks and are usually concentrated among just 15-30 holdings. We carefully consider our sector exposure, along with the potential impacts of outside economic and regulatory shifts, adjusting and rebalancing as necessary to maintain what we believe to be an appropriate risk profile for each strategy.

Learn more about our strategies

Asset AllocationMaking it right for you

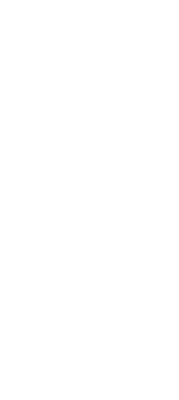

The final step in the process is to tailor these strategies to your specific needs and goals.* As a fiduciary and Registered Investment Adviser, we always put your interests first. Depending on your specific Investor Profile, we can combine our strategies into over 140 unique portfolio allocations. Your allocation is designed to give you what we believe to be a better potential to meet your long-term investment goals with confidence and peace of mind along the way!

Get more details on how we allocate

Stock PickingDiscovering potential winners

We believe high-quality businesses make an excellent foundation for most long-term portfolios. The trick is finding them. That’s where our team of expert portfolio managers comes in. Using our proprietary Four Pillars of Quality, they find companies they believe can thrive over the long term, potentially rewarding shareholders along the way. This first layer sets the foundation for all we do.

Learn more about how we pick stocksPortfolio ConstructionManaging risk/reward

It’s one thing to find great stocks. Heck, you may have picked a few winners yourself over the years! But getting select baskets of stocks working together in concentrated portfolios is a whole ‘nother challenge. We run six distinctive portfolio strategies geared toward specific kinds of stocks along with one Fixed Income strategy. These strategies only include our portfolio managers’ highest conviction picks and are usually concentrated among just 15-30 holdings. We carefully consider our sector exposure, along with the potential impacts of outside economic and regulatory shifts, adjusting and rebalancing as necessary to maintain what we believe to be an appropriate risk profile for each strategy.

Learn more about our seven strategiesAsset AllocationMaking it right for you

The final step in the process is to tailor these strategies to your specific needs and goals. As a fiduciary and Registered Investment Adviser, we always put your interests first. Depending on your specific Investor Profile, we can combine our strategies into over 140 unique portfolio allocations. Your allocation is designed to give you the best opportunity to meet your long-term investment goals with confidence and peace of mind along the way!

Get more details on how we alloctateTell us about yourself

Fill out the form below and answer a few simple questions about your financial goals to complete your Investor Profile.

Answer a few questions about your financial goals to complete your Investor Profile.

Get your free Personal Portfolio Recommendation

Review, explore, and approve your Personal Portfolio recommendation based on the answers you provided.

Create and fund your account

Set up and fund your new Tradesace account with our help.