Your portfolio is your nest egg. It represents not only the hard work you’ve put in over the years to save and invest for the future, it represents your goals, your hopes, and your dreams.

We want you to feel confident that your future is in good hands with our team. That’s why we offer an active, hands-on approach led by our in-house portfolio managers.

Ups and downs, bulls and bears… Your investment strategy should be built to see you through.

Everyone is looking for that financial advisor who can tell you exactly what the market will do over the next 6-12 months… and allocate your investments to take full advantage.

Spoiler alert: That advisor doesn’t exist.

Don’t get us wrong… Playing the prediction game can be a lot of fun. But when it comes to your retirement nest egg, or the wealth you hope to pass on to your loved ones, you need a financial foundation you can believe in – no matter what the future holds.

That’s why our Portfolio Managers construct our exclusive portfolio strategies around only their highest-conviction stock picks… companies that we believe have the potential to thrive in multiple possible futures and should create the foundation for resilient portfolios.

Why Active Management?

As active managers, we do all the buying, selling, and rebalancing within your account. We carefully monitor each of our current holdings, and look for new opportunities in the market.

That means you can take the pressure of managing investments off your own shoulders and put it in the hands of professional analysts with extensive experience in steering portfolios through the ups and downs of the market.

Our portfolio managers are experienced financial analysts with an eye toward identifying companies they believe could be poised to deliver market-beating returns over multi-year periods while minimizing volatility.

As Tony Arsta,CFA and manager of our large cap strategies puts it,

“My job is to worry about everything, all the time, so our clients don’t have to.”

You’ve probably heard about the value of diversification in a portfolio. It’s a sound principle! However, it’s also possible to be over-diversified. In which case, the returns of your biggest gainers can possibly be offset by the losers in your portfolio, and you could end up with returns that are merely average.

But if you’d like the opportunity to potentially outperform the market, we believe a carefully constructed portfolio consisting of roughly 15-30 stocks held over multi-year timeframes can give us a better chance of doing so.

Unlike a mutual fund that might include hundreds of holdings, or an index fund that might track a segment of the market without taking into account business quality, our equity strategies are different. They are highly concentrated, typically only holding between 15 and 30 of our team’s highest conviction stocks.

We believe this approach has the potential to lead our strategies to enjoy compounding returns over time, and offer clients the potential to realize gains that could surpass those of market indexes given a long enough time horizon.

At the same time, we are always mindful of risk. All investments involve risks and may lose money. So we approach the market with confidence and humility. We don’t know what the future holds. And we will make some mistakes along the way.

But we believe that by sticking to our fundamental process we should be able to construct portfolios with the potential to reliably compound returns and build wealth while minimizing volatility for investors like you, through good markets and bad – bulls, bears, and all the wild animals in between!

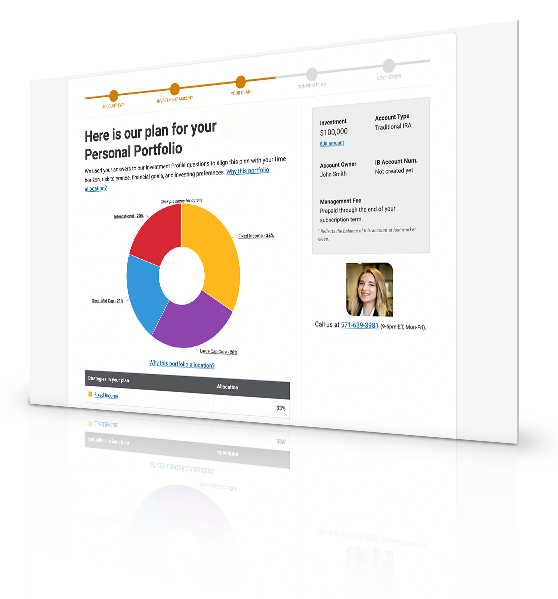

Asset Allocation: Bringing It All Together… Your Asset Allocation is Tailored to Your Specific Goals

We believe that success in the stock market isn’t only driven by which stocks you invest in, but in what combination. That’s why asset allocation can be such an important piece of what we do.

Once we learn about your financial situation, we can determine which of our seven exclusive portfolio strategies are right for you. By allocating certain percentages of your cash to different strategies, we can fine-tune your allocation according to your needs and goals.

First, we look at the purpose of your wealth plan. Are you earning and saving for your own retirement? Are you already retired and trying to make your nest egg last? Are you building a trust to pass on to your kids or grandkids? Different goals require different plans.

Then, we consider your risk capacity. How long will it be before you need to withdraw funds from your account? Do regular withdrawals and spending need to be factored in? How much volatility can you reasonably afford within your portfolio?

Next comes your risk tolerance. Often there is more than one allocation that’s potentially appropriate for your investment goals. We can dial your allocation to be more aggressive or more conservative depending on the level of volatility you’re personally comfortable with.

It all comes together in a hand-tailored asset allocation that’s appropriate for your current needs, and your future goals.* It’s an investment plan designed to potentially see you through the years and decades to come, and one we hope will give you peace of mind and confidence going forward.

Get your custom asset allocation recommendation in just a few minutes by filling out the form below.