Studies show success in the stock market isn’t only driven by which stocks you invest in, but in what combination. That’s why asset allocation is so important.

Once we learn about your financial situation, we can determine which of our seven exclusive portfolio strategies are right for you — and in what combination. By allocating different percentages of your cash to different strategies, we can fine-tune your allocation according to your current needs and your future goals.*

Here are the main factors that determine what asset allocation is potentially best suited to your needs:

Goals

Why are you investing?

These days we think wealth looks more “motley” than ever. Peoples’ dreams are as unique as they are. We have clients who travel the world, live on sailboats, own cattle ranches, and have wild hobbies like rocket paragliding. We believe that your wealth strategy should be built around your goals, your priorities, and your needs.

Risk Capacity

What's your ability to afford losses?

Given a long enough time horizon, the market has always moved up and to the right. But we must consider how the temporary ups and downs could affect you specifically. We’ll determine the timeline of your portfolio — whether it’s intended for short-, intermediate-, or long-term goals — as well as your spending needs to ensure you don’t take on more risk than you can reasonably afford.

Risk Tolerance

What's your psychological reaction to potential market declines?

When it comes to investing in the stock market, we often say that volatility is the price of admission. And an ability to stomach volatility is key to long-term success. We can repeat these maxims until we’re blue in the face, but if the fluctuations in your account balance causes you to lose sleep at night, it’s not the right plan for you. We’ll work to find an allocation that can potentially keep you on track toward your goals without inducing unnecessary anxiety. Because our goal isn’t only to grow your wealth; it’s to improve your overall quality of life.

Asset Allocation

What percentage of each asset class should be in your portfolio?

As you may have noticed, we consider ourselves a “stock shop.” And we believe firmly in the long-term wealth building potential of our individual stock selections. But depending on the factors above, we may find it appropriate to allocate portions of your portfolio to bonds, certain ETFs, cash, hedged strategies, or options. Even within the realm of stocks, your allocation may skew more heavily toward more conservative large-cap, dividend-paying companies, or toward more aggressive, high-growth-oriented stocks. Your precise allocation depends on the factors mentioned above.

Monitor Performance

Are you on track?

Even for the best investors, markets can often prove unpredictable. We strive to prepare your portfolio to face multiple possible futures, but even the pros can’t anticipate every eventuality. We regularly compare your asset level to the wealth plan we’ve laid out for you, and determine whether changes are necessary based on your actual vs. expected returns, along with any shifts in your personal circumstances.

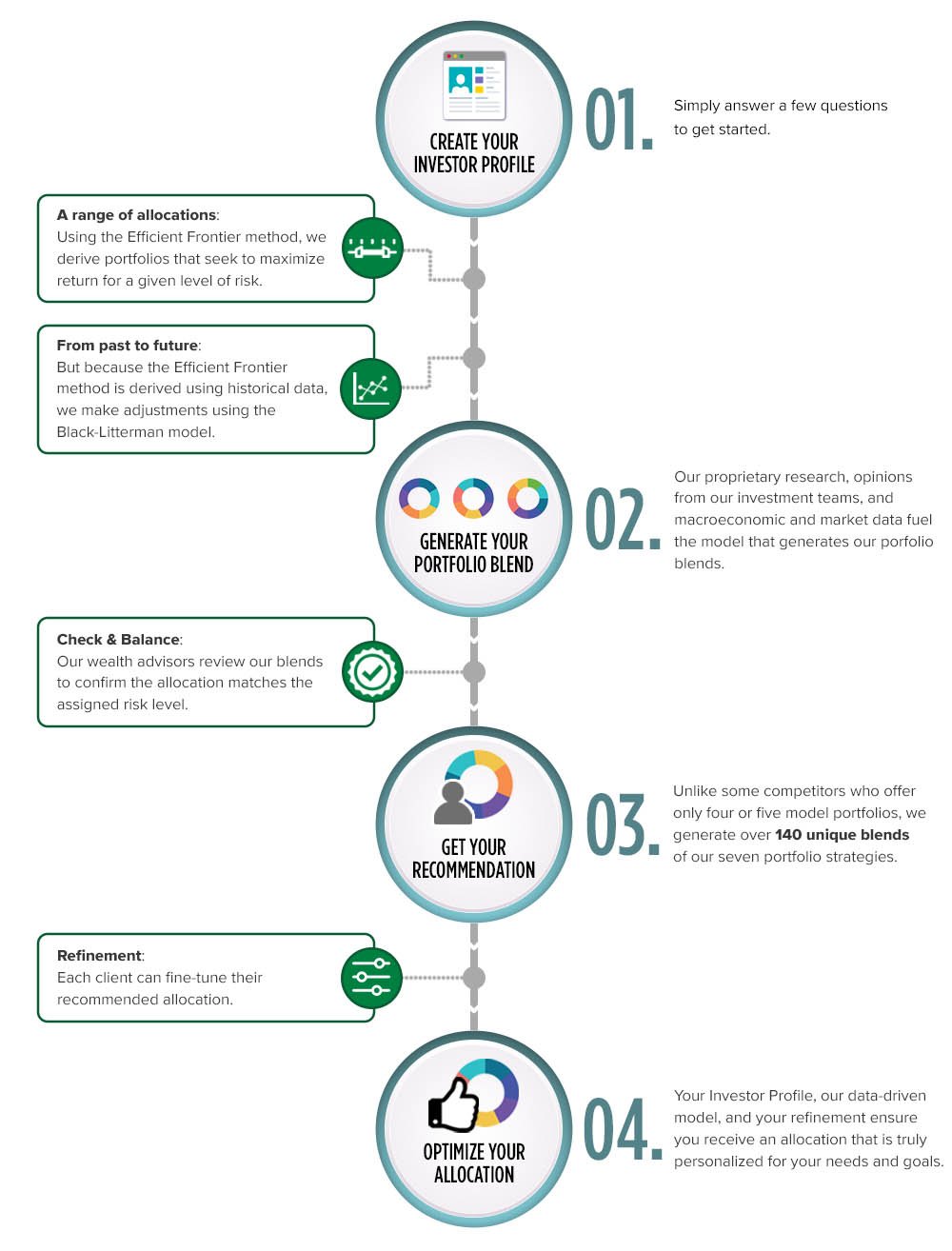

Ready to see the asset allocation we’d recommend for you? Here’s how it works…

Your Asset Allocation Process

Your recommended asset allocation may include a mix of large U.S. companies, small or midsize companies, and International stocks — along with certain ETFs, bonds, and options that may help to diversify your portfolio and mitigate risk.

Your precise asset allocation is tailored to you! Create your Investor Profile by filling out the form below, and see the allocation we’d recommend for you.